📈Callisto Dynamic Monetary Policy

Abstract

The majority of cryptocurrencies follow a static block reward emission to compensate miners. Most of the time, this approach fails to address the long-term network requirements, mainly security, and stability.

In this article, we propose a dynamic monetary policy. This policy combines a fixed reward per block that decreases with time and a burning mechanism, which is used to burn coins based on the network utilization, therefore decreasing inflation.

The approach can be split into two different phases, when the network utilization is low, no coins are burned, and miners compete to get the fixed block reward. As the network usage increases, the miners’ reward remains unchanged, while the total supply of coins is reduced, increasing the value of the coins in circulation.

Inflation and deflation periods can make a network unstable. We believe that using a type of mechanism to control the network parameters to maintain the total coin supply at a minimum threshold (3,000,000,000 CLO) will provide the network with optimal stability.

The advantage of this approach is the adaptability to different circumstances, ensuring long-term network viability with the objective of network growth.

Introduction

Cryptocurrencies have attracted a lot of interest and are seen as the digital evolution of money, evolving over time to meet consumer demand. However, research remains insufficient with the different policies and their responses to both long-term and short-term effects.

The majority of the existing projects follow a static approach (1) and a maximum total supply, such as the one introduced by Bitcoin (2). According to this model, the bitcoin miners would continue to support the blockchain through the process of mining, with the transaction rewards being enough to support such a model when the total supply limit is reached.

In reality, this approach is not applicable to the majority of the existing blockchain projects. In contrast to Bitcoin, they may fail to achieve the targeted network utilization and the expected transaction cost to ensure the network’s secure operation. Updates through hard forks are often required, resulting in problems for the stakeholders and discouraging investors from making long-term plans.

Ethereum (3), Dogecoin (4), and other projects follow a different approach, where the block reward (coin emission) is fixed with time. This can result in inflation, which in the long term lowers the value of the existing coins. Hence, proposals (EIP-1559 (5)) come into play, to follow a more dynamic approach. They introduce a burning mechanism that would decrease the inflation rate, (6) even to negative values (deflation).

We believe such an approach can have a significant impact in the blockchain space in a positive way. The burning mechanism would reflect the network usage, adjust the coin issuance rate to the network utilization, and motivate miners to continue securing the network regardless of the current network state.

Callisto Network could benefit from this approach by adopting the proposed dynamic monetary policy along with a transaction fee-burning mechanism. Such an approach helps to keep the network stable as it offers incentives to miners to support the network, while the expected network utilization will increase the intrinsic value of the coin over time.

Specifically, the alternation between inflation and deflation periods results in an ecosystem that rewards its stakeholders when the utilization is high, triggering changes in network parameters to ensure its long-term viability.To be more specific, the fixed block reward policy offers the required incentives to miners to continue supporting the project and its network security while the network utilization is low.

In contrast, a fixed monetary policy, which terminates the block reward when the maximum coin supply is reached, without knowing what the network utilization might be, could result in severe degradation of the network security by decreasing the mining hash rate and consequently making the network prone to attacks.

When the network utilization is high, and blocks are filled with transactions, an appropriate burning mechanism would decrease the inflation rate, even to a negative ratio (deflation). Depending on the network utilization and the selected policy, this offers extra value to the respective coin by decreasing the total number of coins in circulation in response to its utility value. As known, inflation reduces the value of currency over time, while deflation increases it.

We believe that the value of the coin is closely related to its utilization. Hence, the burning mechanism will result in deflation when the network utilization is high and in inflation when the network utilization is low. Such an approach is viable in the long-term by giving incentives to miners supporting the project in periods of low and high utilization, while the projects with fixed emission policies fail to do so. Also, in high utilization periods, miners will be rewarded by higher value rewards, giving the required incentives to further increase network security.

In an analogy to multi-agent systems, the proposed mechanism can be assumed to consist of two competing agents. One static agent controls the block reward at different periods of time, and that is predefined. The second and dynamic agent competes with the first one by burning part of the transaction fees, therefore decreasing the total coin emission.

Control Parameters

In the following, we have collected the parameters that are incorporated in the monetary policy. As technology evolves with time, the network parameters such as (i) Block size, (ii) Minimum transaction fee, (iii) Cost per transaction, and (iv) CS reward can change with time as larger sizes of blocks are expected to be supported in the future.

Such changes cannot be forecasted in detail and can lead to unexpected inflation rates. Also, full utilization of the network without changes of such parameters could result in continuous deflation, rendering the coin unusable. Due to this, for the first time, we plan to implement a mechanism that would be triggered at periods of high inflation and deflation to ensure the appropriate distribution of rewards to the different participants in the network. In the case of Callisto Network, to the (i) Cold Stakers (CS), (ii) Miners, and (iii) Users.

Furthermore, a higher deflation rate increases the CS Annual Percentage Return (APR). To avoid the coin being used only as a store of value, decreasing its utilization, we decided to use an upper limit on the maximum worst-case APR.

Block reward and System of Systems approach

For the block reward policy, we propose to follow the approach that is adopted by the majority of the cryptocurrencies and decrease block rewards over time instead of reducing it until the total coin emission is reached, we propose a minimum threshold in the block reward. This will ensure long-term network stability, independently of the network utilization.

The reason we selected the continuous block reward reduction is based on a System of Systems approach. According to this approach, the whole cryptocurrency ecosystem (a whole system) is perceived as a collection of the different cryptocurrencies (the different systems). Each of the different systems carries weight in the total ecosystem, and following a different basic inflation rate could result in rendering the network unstable by external parameters, as defined for the stability of the whole cryptocurrency system. Particularly, a higher inflation rate compared to the other systems could result in the devaluation of the coin, while high deflation could reduce the utility of the coin.

In regards of the inflation rate over time, when the block reward reaches the predefined minimum value (in our case, 20 coins/block), it will remain fixed forever; see below in Figure 1.

This approach can be seen as a combination of two bigger blockchain projects, namely Bitcoin and Ethereum. Such an approach ensures that the network as a Proof-Of-Work project offers the required incentives to miners to support the project during both inflation and deflation periods while following the trend of all the POW coins and decreasing block rewards over time.

Figure 2 below shows the block reward reduction percentage, the first reduction being the highest one.

Based on the block reward selections from Figure 1, the inflation per year without the existence of a burning mechanism is presented below in Figure 3.

Each block reward will be shared among the (i) Miners, (ii) Cold Stakers, and (iii) the Treasury fund, represented below in Figure 4.

Miners will receive the highest proportion of each block reward, equal to 60%.

The Cold Staking contract will receive 30% of the block reward. This number should ensure that in the worst case (when all coins in circulation are locked in the Cold Staking contract) an APR of 5%.

The remaining part of the block reward, 10%, is allocated to the treasury fund.

The introduced dynamic monetary policy has halted the block reward reduction foreseen by the previous monetary policy for the first effect. Indeed we anticipate a hard fork including changes to the block time, block size, as well as the implementation of burning mechanics to be performed in Q4 2022.

Thus the block reward reductions at block 8 900 001 and after are aborted.

Effect of block reward and total coin supply

The coins allocated to the Cold Staking contract depend on the block reward; thus, the minimum block reward and the total coin supply define the worst-case Cold Staking APR.

For this reason, we target a 3.000.000.000 total coin supply for the long-term stable state of the network. In this case, with the operation of master nodes and with the implementation of new mechanisms in the network, the total number of locked coins in the Cold Staking contract can be decreased, offering a higher APR, while the targeted worst-case short term APR is 5%.

Burning mechanism

Layer 1 offers high safety for transactions, and it should be expected that the minimum transaction cost will increase over time. This is based on the assumption that the total available space in Layer 1 is limited to a number of transactions, which will increase over time. As more transactions will compete for block space, transaction costs will increase.

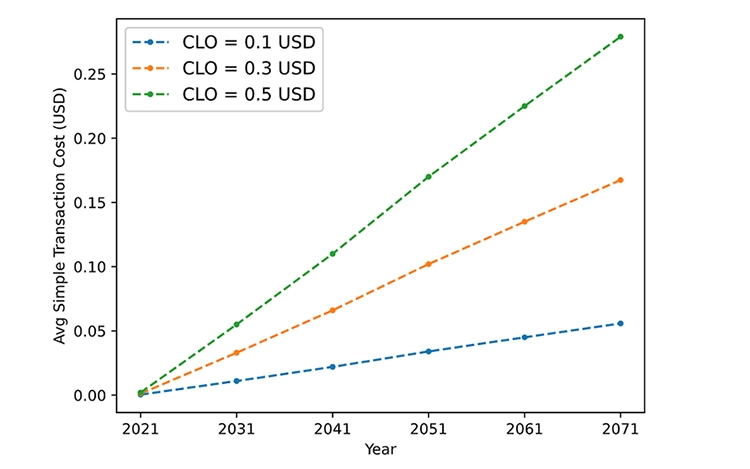

The assumed model below in Figure 5 shows an average base cost per simple transaction, which ensures that Callisto Network will be competitive in terms of average transaction cost among the cheapest networks of all the Layer 1 networks, leaving more room for changes over time.

The cost of transactions in the following graph (Figure 5) is based on the different CLO coin prices assumptions.

Two parameters can be controlled to increase the base fee of each transaction, namely (i) the block size and (ii) directly controlling the price increase of the transaction.

A larger block size would result in more transactions per block. With the improvements in hardware, it is reasonable to assume a 1% block size increase per year. Once it reaches a size that is double the current block size, it remains fixed forever. Therefore, blocks can contain more simple transactions as they grow over time.

Assuming the previously mentioned block size increase, the block size over time is represented below in Figure 6.

The base fee can be burned, and miners, in addition to the block reward, will also share the extra fee paid for higher priority when submitting the transaction.

Transaction_cost = Base_fee + Extra_ fee (1).

Miners will share the rewards from the fee upon validation of new blocks. In a future article, we will define the changes in the way transactions are validated by miners.

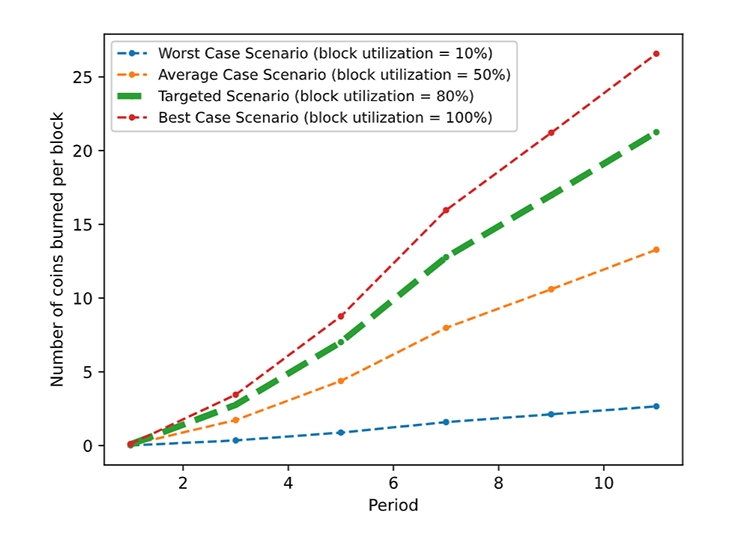

For our projections we have assumed four different static block utilization scenarios, namely the (i) worst-case = 10%, (ii) average case =50%, (iii) target case = 80% and (iv) best case = 100%.

We selected a static utilization to showcase its effect on the proposed Monetary Policy, while it can correspond to the average value either long term or short term. Note that the target case corresponds to the projected coin emission based on our short-term transaction expectations.

Based on the assumptions above, the number of coins that can be burned within a block period are presented below in Figure 7.

Note that the time periods we have chosen for our simulations represent five (5) years each, to illustrate the monetary policy dynamics over time. However, given the dynamic nature of the monetary policy and the fact that the exact parameters will be defined more precisely over time, more extensive simulations will be performed in the near future.

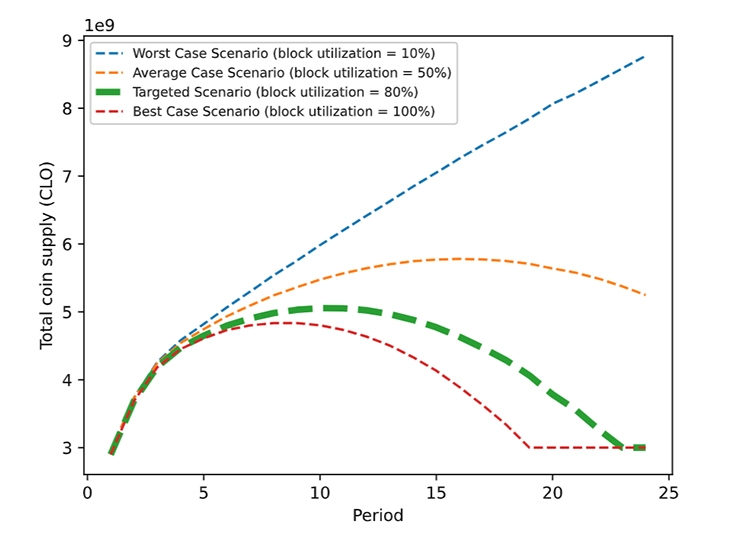

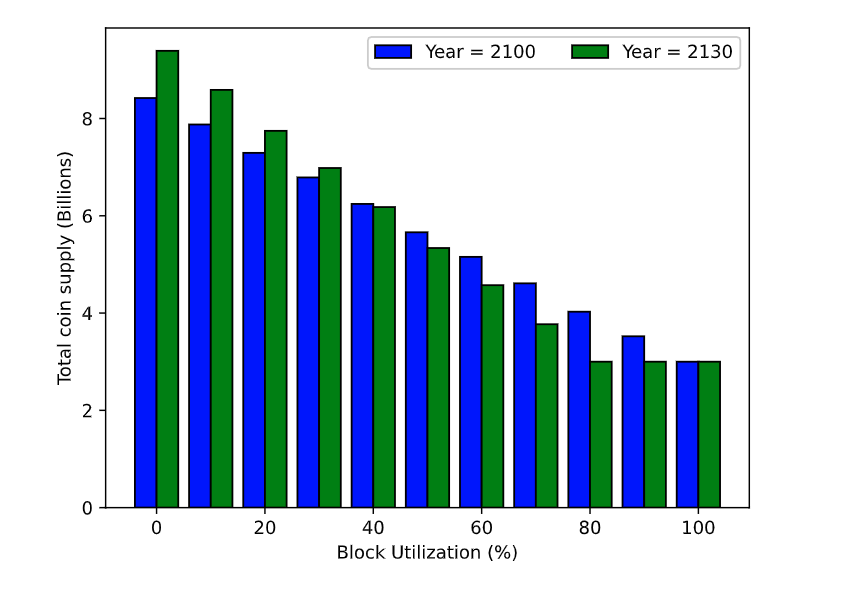

Moreover, the examined on-chain transactions projections (utilization ratio), for the different usage scenarios would result in the coins total supply scenarios illustrated in Figure 9.

Finally, the projected total coin supply, assuming different static utilization scenarios, from 2021 until years 2100 and 2130, is presented in Figure 9.

As shown in the previous figures, the proposed Monetary Policy will result in a 3 billion total coin supply in the long term. In addition, the high short-term usage, which is expected to be equal to 80%, will significantly reduce inflation resulting in deflation.

Note that more burning mechanisms are currently under consideration and will be published over time. These mechanisms, depending on the blockchain utilization, will result in further decreasing inflation.

Cold staking users also benefit from deflation periods, as the total coins supply decreases, resulting in an increase in APR. (Cold Staking reward does not depend on inflation/deflation but only on fixed block rewards).

Conclusion

In this article, we provided the vision of the Callisto Network Monetary Policy.

The proposed Monetary Policy offers incentives to miners to support the network independently of its utilization, achieving long-term network stability while also attracting long-term investors.

The total coin supply when the network is fully utilized is set to be 3 billion coins. The Cold Staking rewards are targeted to be 5% (APR) in the worst-case scenario (all coins locked) with the implementation of master nodes and the new burning mechanisms. Note that while the Cold Staking reward remains fixed as it depends only on the block reward, the total coin supply reduction will result in increasing the Cold Staking APR over time.

References

[1] Nakamoto, Satoshi, “Bitcoin: A peer-to-peer electronic cash system” , 2009.

[2] Wood, Gavin, ”Ethereum: A secure decentralised generalised transaction ledger”, 2014.

[3] Dogecoin, “https://github.com/dogecoin/dogecoin” .

[4] Tim Roughgarden, “Transaction Fee Mechanism Design for the Ethereum Blockchain: An Economic Analysis of EIP-1559” , 2020.

[5] Investopedia, “How Bitcoin mining works”.

[6] Investopedia, “What Impact Does Inflation Have on the Dollar Value Today?”.

Last updated